monterey county property tax due dates

Ultimate Monterey Park Real Property Tax Guide for 2022. Tax bills are generated every fiscal year July 1 through June 30 and mailed in mid-October and payment may be made in two.

Monterey County California Fha Va And Usda Loan Information

You can contact the Monterey County Assessor for.

. 1-831-755-5057 - Monterey County Tax Collectors main telephone number. A convenience fee is charged for paying with a CreditDebit card. The installments due dates for fiscal 2021-2022 tax year are.

For credit cards the fee is 225 of the total amount you are paying. October Tax bills are mailed. Supplemental tax bills are mailed.

The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and innovative services in the collection of property taxes. Additional evidence supporting your appeal will be needed. January 1 - Lien date the date taxable value is established and property taxes become a lien on the property.

For E-Check a flat fee of 025 is charged. All major cards MasterCard American Express Visa and Discover are accepted. December 10 Last day to pay First Installment without penalties.

Second Installments of 202122 Annual Secured Property Tax Bills are due as of February 1st. April 10 Last day to pay 2nd installment of property taxes without penalty. Yes you can pay your property taxes by using a DebitCredit card.

The state relies on real estate tax revenues a lot. Sewage treatment plants and athletic parks with all dependent on the real property tax. November 1 First Installment is due.

Choose Option 3 to pay taxes. April 10 Last day to pay Second Installment without penalties. Monterey county property tax due dates 2021.

If taxes remain unpaid at 500 pm. Secured property taxes are levied on property as it exists on January 1st at 1201 am. The Trustee deposits collected taxes into secure investments until they are distributed to all county offices for their budgets as set by the county commission.

A 10 penalty is added as of 5 pm. Discover Pennsylvania Property Tax Due Dates for getting more useful information about real estate apartment mortgages near you. San Luis Obispo CA 93408-1003.

Payments made by credit card or debit card require a 235 processing fee paid to the payment processor with a minimum processing charge of 149. If you are currently living here. You will need your 12-digit ASMT number found on your tax bill to make payments by phone.

County Tax Collector or SLOCTC 1055 Monterey St Room D-290. If you need to pay your property tax bill ask about a property tax assessment look up the Monterey County property tax due date or find property tax records visit the Monterey County Tax Assessors page. Between January 1 2022 and March.

For assistance in locating your ASMT number contact our office at 831 755-5057. See note October - Treasurer-Tax Collector mails out original secured property tax bills. Post Office Box 390.

July 1 Oct. August 1- Unsecured bills due. August 31 - Unsecured deadline.

July 1 - Beginning of the Countys fiscal year. A 10 penalty will be added if not paid as of 500 pm. The Trustees Office has no control of the amount.

If paying by mail please make the check payable to. The Trustee acts as the countys banker and also collects county taxes. Affects the upcoming fiscal year January 31.

Alisal St 3rd Floor. Monterey County collects on average 051 of a propertys assessed fair market value as property tax. PROPERTY TAXES IS THIS FRIDAY.

The Monterey County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Monterey County California. Only current year taxes may be paid by phone. The VAF Return Form must be mailed to or filed at the City of Monterey Finance Department accompanied by remittance for taxes due and will be due on the 15th day of the following month.

Normally local school districts are a significant draw on property tax funds. Property tax assessments in Monterey County are the responsibility of the Monterey County Tax Assessor whose office is located in Salinas California. Any property owner with questions about their property tax bill should contact the Tax Collectors Office at 831-755-5057 or taxcollectorcomontereycaus Property Tax Due Date Reminder.

BEYOND APRIL 10TH. May 7 Last Day to file business property statement without penalty July 1 Start of the Countys fiscal year. Checking the Monterey County property tax due date.

Transient Occupancy Tax TOT delinquency deadline if not paid before 500 pm. Monterey County has one of the highest median property taxes in the United States and is ranked 178th of the 3143 counties in order of median property taxes. The Trustees Office is responsible for managing over 211 million per year for all county finances.

July 2. 15 Period for filing claims for Senior Citizens Tax Assistance. January 1 Lien Datethe day your propertys value is assessed.

If taxes due are not paid on or before the date they become delinquent a penalty of 10 percent attaches. Not only for Monterey County and cities but down to special-purpose districts as well eg. Discover Calif Property Taxes Due Dates for getting more useful information about real estate apartment mortgages near you.

Before you begin please ensure all rent and applicable fees are included in the amount reported. February 1 Second Installment is due. First installment of secured property taxes is due and payable.

Monterey County collects on average 051 of a propertys assessed fair market value as property tax. First installment of secured property taxes payment deadline. Discover Florida Property Taxes Due Date for getting more useful information about real estate apartment mortgages near you.

This due date is set by the Assessor and may vary. IN MONTERE COUNTY THE TAX COLLECTOR THERE SAYS HER OFFICE IS BEIN FLOODED WITH CALLERS ASKING IF THE DUE DATE CAN BE EXTENDED. The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300.

A 10 penalty is added if not paid before 500 pm January 1. The tax statements were mailed out on august 19 2021. Monterey County California - Assessors Office.

Property Tax Calendar All Taxes. Understand how Monterey Park sets its real estate taxes with this thorough guide.

Business Assistance Monterey County Ca

At A Glance Monterey County Monterey County Ca

Where Property Taxes Go Monterey County Ca

District Attorney Monterey County Ca

Our Work United Way Monterey County

Monterey County Regional Fire District

Monterey County Health Department Announces Timeline For Advancing Through Phase 1b For Covid 19 Vaccinations Vaccine Supplies Are Still Very Limited News Information Monterey County Ca

The California Transfer Tax Who Pays What In Monterey County

Covid 19 Infographics Posters Monterey County Ca

Monterey County Ca Property Data Real Estate Comps Statistics Reports

Official Monterey County Flag Monterey County Ca

Monterey County Board Of Supervisors Approves Redistricting Plan Monterey Herald

Contact Us United Way Monterey County

Monterey County Preschool Service Corps United Way Monterey County

The California Transfer Tax Who Pays What In Monterey County

North County Area Monterey County Ca

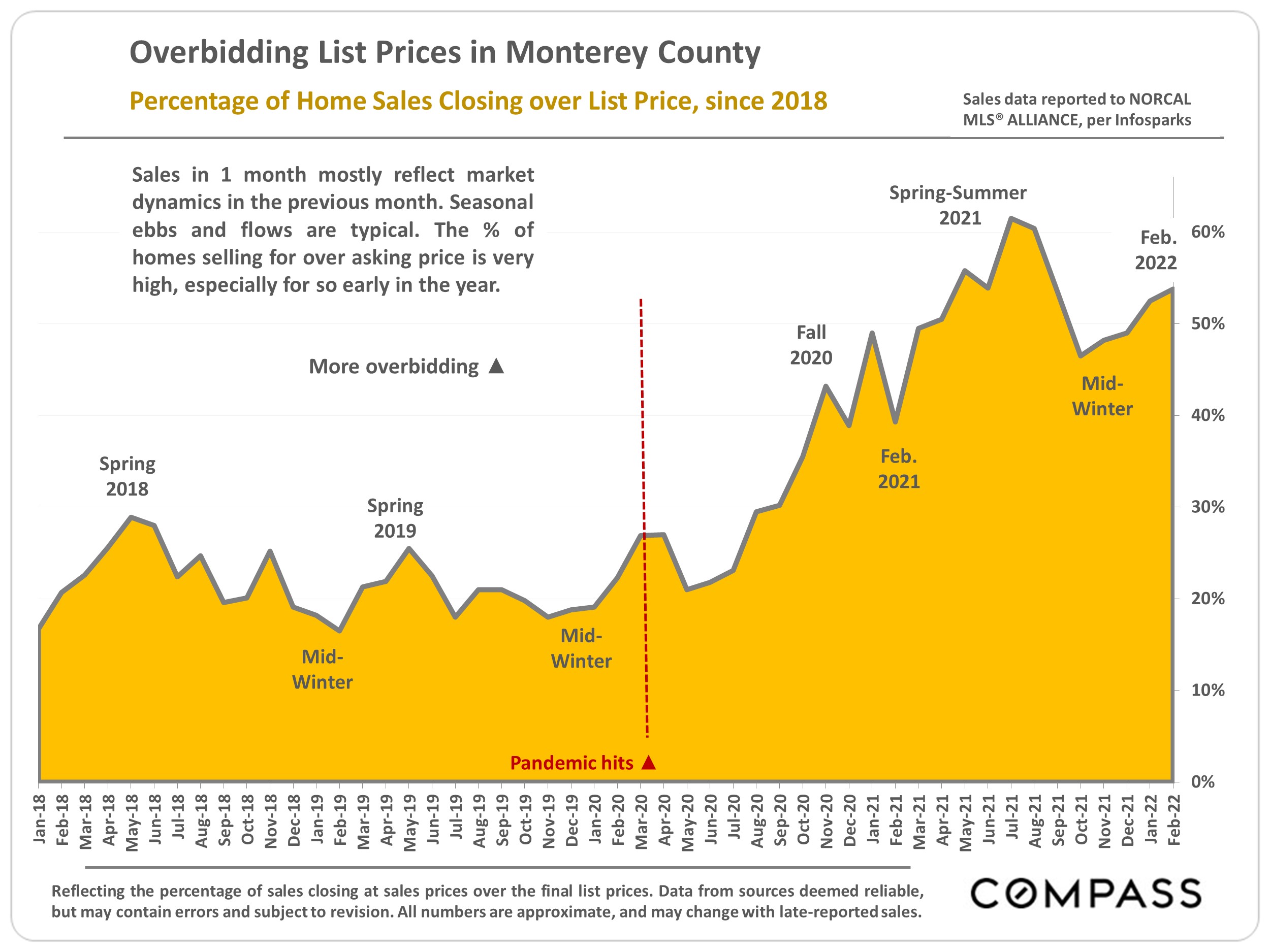

Monterey County Home Prices Market Trends Compass